Constant economic crises force investors to look for reliable ways to preserve their capital. During such periods, attention usually shifts toward gold and the stocks of major companies. In this review, we'll explain how to safely purchase U.S. stocks and digital gold through a cryptocurrency exchange.

Content:

- Gold as an investment

- Tokenized shares and digital assets

- The Future of Digital Investments

- Bottom Line: Are Digital Stocks and Gold Worth Investing in?

Gold as an Investment

When the global economy faces turmoil, many assets quickly lose value. Gold, on the contrary, tends to rise in price and maintain its appeal. That’s why it’s often called a “safe haven” — an asset that helps reduce risks and protect investors’ capital.

Why Buy Gold and What is the Best Form to Do It?

Gold has long been a means of protecting capital, especially in times of economic instability, rising inflation, and stock market corrections. Today, investors have several ways to invest in this metal:

- Physical gold – bars or coins that will have to be stored and insured somewhere;

- Gold ETFs are a simpler and more liquid option; they are easy to buy and sell;

- Digital gold is a blockchain-based token that verifies your ownership of the metal.

Each option has its own pros and cons: physical gold requires additional expenses, ETFs are the most convenient for trading, and digital gold is easy to use but depends on technology and its related risks.

XAUt – Digital Gold or a Scam?

One of the most well-known gold tokens is Tether Gold (XAUt). Each such token is backed by one troy ounce of physical metal stored in a Swiss bank. For investors, it’s a convenient way to own gold without worrying about safes or insurance. However, there’s a catch: everything depends on trust in the issuer. If the company behind the token loses its reputation or proves unreliable, the asset’s value can collapse very quickly.

The Best Way to Buy Gold

Each method of purchasing gold has its own strengths and weaknesses. The choice depends on the investor's goals, investment amount, and risk tolerance.

|

How to buy gold |

✔️ Benefits |

❌ Disadvantages |

|

Physical gold (bars, coins) |

Direct ownership, inflation protection, no counterparty risk |

Storage issues, low liquidity, wide bid/ask spreads |

|

Opening an unallocated metal account (OMC) |

Convenience, liquidity, accessibility |

Counterparty risk, no physical ownership, wide spreads |

|

Buying through an ETF |

High liquidity, low costs, accessibility |

No direct ownership, counterparty risk, hidden fees |

|

Buying on crypto exchanges (tokenized gold) |

High liquidity, decentralization, 24/7 availability |

High volatility, risks of exchange or wallet hacking, insufficient regulation |

The format of gold investment largely depends on what you expect from it and how prepared you are for additional expenses.

If you need a simple “safety cushion” in case of a crisis, physical gold — bars or coins — is the most reliable option, but only if you can ensure proper storage.

When gold is viewed more as an investment instrument, ETFs are more convenient. They’re liquid, easy to buy and sell, and you don’t need to worry about safes or insurance.

There’s also an intermediate option — unallocated metal accounts (UMAs). In this case, you track the gold’s value, but the metal doesn’t physically belong to you. It’s suitable for those who trust their bank and don’t want to spend money on renting a safe deposit box.

If you're already familiar with cryptocurrencies and comfortable with technological risks, you might consider tokenized gold. For example, Tether Gold (XAUt) combines the value of traditional metal with the convenience of digital assets.

Tokenized Shares and Digital Assets

Asset tokenization is one of the most recent and exciting ideas at the intersection of finance and blockchain. Essentially, it's the transfer of ownership of real assets into digital form. As a result, tokens are created on the network that confirm your share or right to a specific asset. Virtually everything can be digitized: from works of art and gold to real estate, stocks, and bonds.

What are Tokenized Shares and How Can you Make Money with Them?

Tokenized stocks are digital copies of traditional securities issued on the blockchain. One token represents one share of a real company. This format allows investors to buy even fractional shares of expensive companies like Tesla by investing just a few dollars. In essence, it’s a simplified way to gain access to global corporations through a crypto exchange without opening a brokerage account. Profit comes from the token’s price growth and, in some cases, from dividends if the issuer distributes them.

However, there are important nuances. Holders of tokenized stocks do not receive voting rights at shareholder meetings. In addition, regulations vary across countries and remain unclear, which may lead to restrictions or even trading suspensions. Another critical aspect is investor protection. In the traditional model, shares are purchased through a licensed broker, while here everything depends on the stability of the crypto exchange. If the platform proves unreliable, suffers a hack, or shuts down, recovering your investment may be nearly impossible.

Who Issues Tokenized Shares?

Tokenized stocks (xStocks) are issued by the Swiss company Backed Asset Limited in partnership with several crypto exchanges. At the time of writing, they could be found on platforms such as Kraken, ByBit, Gate, and Bitget. The structure works as follows: real shares are held by custodial institutions that act as collateral holders. Tokens are then issued on the Solana network against these shares, and it is those tokens that circulate on the market.

In addition to tokenized company shares, there are also tokenized funds in circulation — for example, SPYx (SP500 xStock).

How Does Digital Asset Tokenization Work?

Let's take a look at how Backed issues tokenized shares. The process is quite simple:

- Shares of American companies are purchased at Interactive Brokers;

- The shares are transferred to the European depository Clearstream;

- Tokens are issued in a 1:1 ratio (1 share = 1 token);

- Tokens are listed on crypto exchanges Kraken, ByBit, Gate, and Bitget.

Please note: because the cryptocurrency market operates 24/7, during periods when traditional stock markets are closed, tokenized stock charts may show price fluctuations within a very narrow range.

Risks of Tokenized Shares

Tokenized shares, despite all their advantages, also have significant risks:

- Legal uncertainty — not all countries recognize such assets as full-fledged securities;

- Dependence on the issuer — if the company issuing the tokens goes bankrupt, the collateral behind them will disappear;

- Low liquidity compared to classic shares;

- Technological risks associated with the operation of the blockchain and the exchange itself.

A good example is the story of Binance Stock Token. In April 2021, Binance launched this project but shut it down by October under pressure from regulators in Germany and the United Kingdom. Local supervisory authorities, BaFin and the FCA, accused the exchange of trading securities without proper licenses and violating financial regulations. As a result, Binance’s management decided the risks were too high and shifted its focus back to its core business — cryptocurrency trading.

Top Tokenized Stocks by Market Cap

Although tokenized stocks have been around for several years, they are still far from reaching the level of traditional stock markets. The main obstacles are strict regulatory pressure and the absence of a unified settlement system.

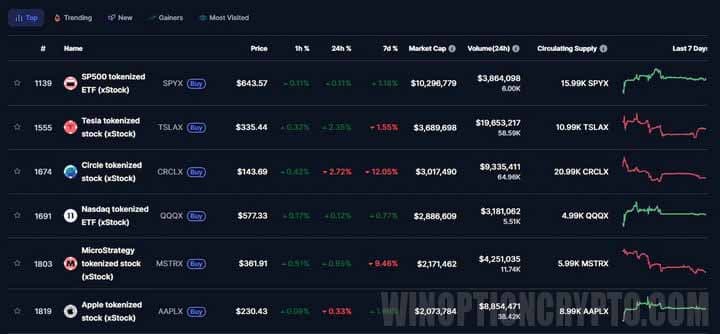

Nevertheless, clear trends are emerging in the market. According to data from CoinMarketCap, the greatest interest is drawn to projects where tokens are backed by shares in funds or well-known companies. Among the leaders are SP500 ETF, Tesla, Circle, Nasdaq ETF, MicroStrategy, and Apple.

How to Buy Tokenized Shares

For example, let’s take the process of buying tokenized stocks on the ByBit exchange. After logging into your account, open the “Markets” tab, then select the “Spot” section and go to the “xStocks” category. From the list of available tokenized stocks, choose the desired instrument and click “Trade.” The trading terminal will then open, where you can buy or sell the selected asset.

The Future of Digital Investments

The future of digital investments is largely shaped by several key trends. Above all, these include the rapid development of blockchain technology, the integration of artificial intelligence, process automation, and the emergence of new models of asset ownership.

Digital Funds – Assets of the Future

The modern financial market is rapidly moving toward digitalization. Even today, tokenized funds containing stocks, bonds, and commodities make it possible to build investment portfolios in just a few clicks. This approach makes investing convenient, transparent, and accessible to almost everyone.

RWA is a New Trend in the Crypto Market

Anyone who follows the cryptocurrency market knows that asset tokenization is one of its main trends. Therefore, it makes sense to pay attention to companies actively working in this area in order to acquire promising tokens at an early stage. Tokenized gold and silver already exist — for example, Tether, the creator of USDT, has its own gold-backed token, with each unit secured by physical bullion. At the same time, two clear tendencies can be observed in the market: on one hand, the rapid growth of asset tokenization; on the other, a long list of tokenized stock projects that have failed to meet expectations.

Prospects for Tokenized Assets

The future of tokenized assets largely depends on the position of the SEC — the U.S. Securities and Exchange Commission. Several scenarios are possible.

In the optimistic scenario, the SEC establishes clear rules for the issuance and trading of tokenized stocks. This would create a transparent and secure environment for investors and give the market a strong boost for growth.

In the neutral scenario, regulation remains limited or inconsistent. This would slow down the development of tokenization but wouldn’t stop it entirely.

In the negative scenario, strict restrictions or outright bans on tokenized securities could be introduced. In that case, part of the market would disappear, and risks for investors would increase significantly.

|

Optimistic |

Neutral |

Negative |

|

Regulators embrace tokenization of the economy |

Regulators are tightening checks |

Regulators accuse exchanges of illegal trading of central banks |

|

xStock becomes the standard |

xStock remains a niche product |

Cryptocurrency exchanges are dividing tokens |

|

Backend Issuer Receives Additional Licenses |

Blocked in some countries |

Backend is leaving the market or changing its product |

Bottom Line: Are Digital Stocks and Gold Worth Investing in?

The appearance of a new product on a crypto exchange doesn’t necessarily mean it’s worth buying right away. The example of Binance’s stock token — which was first launched and later discontinued — clearly shows that many tokenized stocks can disappear from the market. Therefore, as of now, assets like tokenized stocks and gold remain high-risk instruments. It’s important to keep this in mind, especially if you’re planning long-term investments.

Share in the comments whether you have any experience with tokenized assets and what results you’ve achieved.

To leave a comment, you must register or log in to your account.